Kaiser Aluminum Corporation (NASDAQ:KALU) Trading Up – Insiders Selling, Short Interest Growing

Ray Parkinson, VP – Advanced Engineering disclosed the sale of 1,800 shares of KALU stock. The shares were sold on July 24th for an average price of $97.45. Parkinson now owns $954,913 of the stock per the Form 4 SEC filing.

Kaiser Aluminum Corporation, launched on February 20, 1987, manufactures and sells semi-fabricated specialty aluminum mill products. It operates in the Fabricated Products segment. Fabricated Products segment focuses on producing rolled, extruded and drawn aluminum products used principally for aerospace and defense, automotive and general engineering products that include consumer durables, electronics, electrical and machinery and equipment applications. The Company offers its products for various end market applications, such as aerospace and high strength (Aero/HS products); automotive (Automotive Extrusions); general engineering (GE products), and other industrial (Other products). Its fabricated aluminum mill products include flat-rolled (plate and sheet), extruded (rod, bar, hollows and shapes), drawn (anode rod, bar, pipe and tube) and cast aluminum products..

These funds have also shifted positions in (KALU). Paradice Investment Management LLC expanded its position by buying 23,200 shares an increase of 4.3% as of 06/30/2017. Paradice Investment Management LLC currently owns 563,407 shares worth $49,873,000. The total value of its holdings increased 15.5%. Wespac Advisors Socal, LLC reduced its investment by selling 75 shares a decrease of 1.1% in the quarter. Wespac Advisors Socal, LLC controls 6,500 shares valued at $575,000. The value of the position overall is up by 9.5%.

As of the end of the quarter Lombardia Capital Partners LLC had disposed of 111,190 shares trimming its holdings by 94.0%. The value of the investment in Kaiser Aluminum Corporation decreased from $9,189,000 to $567,000 a change of 93.8% for the reporting period. As of quarter end AHL Partners LLP had sold a total of 16,695 shares trimming its stake by 74.3%. The value of the investment in KALU went from $1,795,000 to $511,000 decreasing 71.5% since the last quarter.

July 25 investment analysts at Morgan Stanley left the company rating at “Overweight” but lowered the price target to $87.00 from $95.00. On July 21 Bank of America made no change to the stock rating of “Underperform” and lowered the price target from $92.00 to $85.00.

The company is so far trading up since yesterday’s close of $98.28. Kaiser Aluminum Corporation declared a dividend for shareholders which was paid on Tuesday the 15th of August 2017. The dividend was $0.500 per share for the quarter or $2.00 on an annualized basis. This dividend amount was represent a yeild of $2.04. The ex-dividend date was set for Tuesday the 25th of July 2017.

Company chares are trading at $98.63 which is just a bit higher than the 50 day moving average which is $96.06 and significantly above the 200 day moving average of $86.00. The 50 day moving average was up $2.57 or +2.68% and the 200 day average moved up $12.63.

Kaiser Aluminum Corporation currently has a P/E ratio of 21.66 and market capitalization is 1.66B. In the latest earnings report the EPS was $4.55 and is expected to be $5.47 for the current year with 16,844,000 shares presently outstanding. Next quarter’s EPS is forecasted to be $1.31 with next year’s EPS projected to be $5.78.

Traders are a little more bearish on Kaiser Aluminum Corporation recently as shown by the uptick in short interest. The company recorded a rise in short interest of 3.38% as of the latest report on August 15, 2017. Short shares increased 36,907 over that timeframe. The short-interest ratio increased to 11.0 and the percentage of shorted shares was 0.01% on August 15.

My information:

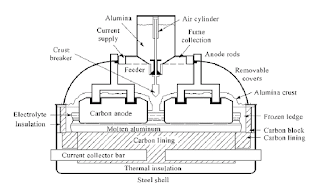

Established in 1995, Zhengzhou Joda Technology Co., Ltd. is a modernized comprehensive enterprise integrating research, manufacture, export and technical service of various types of equipments for aluminum smelters all over the world. Our products: automatic anode jacking frame, ladles accessories, aerogel insulation blanket, anode jacking system, Anode Clamp, bimetal, aluminum ladle cleaning machine and MTV tapping tube cleaner etc.

Company: Zhengzhou Joda Technology Co., Ltd.

Name: anna

Email: mxh@zzjoda.com

Web: www.anodejackingframe.com

Tel: +86 (0) 371 5517 8216

Fax: +86 (0) 371 5517 8216

Code:450016

评论

发表评论