Hindalco reports 73% rise in aluminium EBITDA in FY2017, driven by higher volume

Hindalco reports record standalone/consolidated performance across all operation including aluminium segment for the fourth quarter and the year ended 31 March 2017. Hindalco reported 26% increase in March quarter net profit at INR 503 crore against INR 400 crore in Q4 2016, driven by better realisations. Revenue from operations was up 27% at INR 11,747 crore.

Consolidated revenue for FY2017 was up 7 per cent at INR 39,383 crore while net profit increased more than 50% to INR 1,557 crore. EBITDA for FY2017 stood at a record ?13,558 crore, up 36% compared to FY2016, supported by stable overall operations.

While the company's revenue from the aluminium business grew 9 per cent at ?5,548 crore for Q4 2017, the standalone revenue for aluminium division in FY2017 was also up 9% to stand at INR.19,986 crore, driven by higher sales volume and realization. EBITDA for the quarter increased 13% to stand at INR 1,570 crore. The full year EBITDA was INR 3,473 crore, up 73% compared to INR 2,009 crore in FY 2016, driven by lower input costs, higher volumes with stable plant operations and supportive macro factors.

For the FY2017, the company achieved record aluminium production at 1,266 thousand tonne. Aluminium production was up 12 per cent as compared to FY2016.

Value Added Products (including Wire Rod) production was at 481 thousand tonne, up 14% YoY. Both the new plants, Aditya and Mahan are operating at their rated capacities.

During the fourth quarter, the company raised $500 million through qualified institutional placement and divested stake in its copper mine in Australia.

Novelis, the US subsidiary company, achieved record results during FY 2017, with adjusted EBITDA at USD 1.09 billion, up 13 per cent, driven by operational efficiencies, strategic product shift and favourable currency, partially offset by lower shipments.

Satish Pai, Managing Director, Hindalco Industries, said environmental and supply side restrictions in China is putting about 4 million tonnes of aluminum smelting equipment capacity at risk with significant delay in under-construction projects. This, he expects would drive LME higher continuing the bullish trend in 2017. He expects strong demand and lower inventory to drive the aluminium benchmark prices on LME.

from:

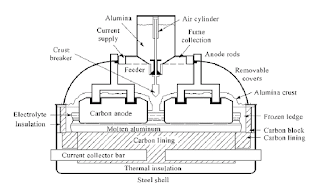

Zhengzhou Joda Technology Co., Ltd. is a modernized comprehensive enterprise integrating research, manufacture, export and technical service of various types of equipments for aluminum smelters all over the world. Our products: automatic anode jacking frame, ladles accessories, aerogel insulation blanket, anode jacking system, Anode Clamp, bimetal, aluminum ladle cleaning machine and MTV tapping tube cleaner etc.

source:

http://www.anodejackingframe.com/productnew/electrolytic-aluminum-anode-busbar-raising-frame.html

http://www.anodejackingframe.com/productnew/electrolytic-aluminum-anode-busbar-raising-frame.html

评论

发表评论