Century Aluminum Company (CENX) Trading Up 5.9%

Century Aluminum Company (NASDAQ:CENX)’s share price was up 5.9% during trading on Tuesday . The company traded as high as $14.74 and last traded at $14.62. Approximately 3,193,129 shares were traded during trading, an increase of 36% from the average daily volume of 2,350,000 shares. The stock had previously closed at $13.81.

A number of equities analysts have recently commented on CENX shares. Zacks Investment Research lowered shares of Century Aluminum from a “buy” rating to a “hold” rating in a report on Monday, October 23rd. BidaskClub lowered shares of Century Aluminum from a “buy” rating to a “hold” rating in a report on Wednesday, August 2nd. J P Morgan Chase & Co lowered shares of Century Aluminum from an “overweight” rating to a “neutral” rating and cut their price target for the stock from $22.00 to $14.50 in a report on Monday, October 30th. Cowen and Company set a $16.00 price target on shares of Century Aluminum and gave the stock a “hold” rating in a report on Sunday, October 29th. Finally, BMO Capital Markets set a $16.00 target price on shares of Century Aluminum and gave the company a “hold” rating in a report on Friday, October 27th. Six analysts have rated the stock with a hold rating and two have given a buy rating to the company’s stock. The company presently has a consensus rating of “Hold” and an average price target of $17.10.

The company has a quick ratio of 1.27, a current ratio of 2.61 and a debt-to-equity ratio of 0.32.

Century Aluminum (NASDAQ:CENX) last released its earnings results on Thursday, October 26th. The industrial products company reported $0.15 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.23 by ($0.08). The firm had revenue of $388.80 million during the quarter, compared to analyst estimates of $392.28 million. Century Aluminum had a negative net margin of 10.45% and a negative return on equity of 0.17%. Century Aluminum’s quarterly revenue was up 16.5% on a year-over-year basis. During the same quarter in the previous year, the firm earned ($0.31) EPS. equities analysts forecast that Century Aluminum Company will post 0.39 earnings per share for the current year.

A number of hedge funds have recently added to or reduced their stakes in CENX. Prudential Financial Inc. lifted its holdings in Century Aluminum by 13.6% in the first quarter. Prudential Financial Inc. now owns 96,609 shares of the industrial products company’s stock valued at $1,226,000 after buying an additional 11,538 shares during the period. Alliancebernstein L.P. lifted its holdings in Century Aluminum by 88.0% in the first quarter. Alliancebernstein L.P. now owns 69,000 shares of the industrial products company’s stock valued at $876,000 after buying an additional 32,300 shares during the period. Principal Financial Group Inc. lifted its holdings in Century Aluminum by 3.9% in the first quarter. Principal Financial Group Inc. now owns 378,009 shares of the industrial products company’s stock valued at $4,797,000 after buying an additional 14,019 shares during the period. Wellington Management Group LLP acquired a new position in Century Aluminum in the first quarter valued at $826,000. Finally, Legal & General Group Plc lifted its holdings in Century Aluminum by 6.7% in the first quarter. Legal & General Group Plc now owns 89,354 shares of the industrial products company’s stock valued at $1,132,000 after buying an additional 5,601 shares during the period. Institutional investors and hedge funds own 67.35% of the company’s stock.

About Company

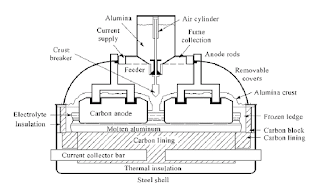

Zhengzhou Joda Technology Co., Ltd. is a modernized comprehensive enterprise integrating research, manufacture, export and technical service of various types of equipments for aluminum smelters all over the world. Our products: automatic anode jacking frame, ladles accessories, aerogel insulation blanket, anode jacking system, Anode Clamp, bimetal, aluminum ladle cleaning machine, anode rod and MTV tapping tube cleaner etc.

评论

发表评论